Introduction

Understanding GST on cars, bikes, and electric vehicles (EVs) is essential for buyers and vehicle enthusiasts in India. With the recent changes in the GST rates, it’s important to stay updated on how these taxes will affect the pricing and cost structure. This article dives into the new GST rates for cars, bikes, and EVs in India, including luxury vehicles. We will break down how GST impacts the automobile sector, answer your burning questions, and provide actionable insights.

GST Rate on Cars in India

|

Car Category |

Engine Capacity & Length | GST Rate | Compensation Cess | Total Tax Rate |

| Small Petrol Cars | Up to 1200 cc, less than 4m length | 28% | 1% | 29% |

| Small Diesel Cars | Up to 1500 cc, less than 4m length | 28% | 3% | 31% |

| Mid-sized Cars | Above 1200 cc (petrol) or 1500 cc (diesel) | 28% | 15% | 43% |

| Luxury Cars | Above 1500 cc | 28% | 20% | 48% |

| SUVs | Above 1500 cc, more than 4m length | 28% | 22% | 50% |

| Electric Vehicles | All capacities | 5% | 0% | 5% |

GST on Cars: What You Need to Know

The Goods and Services Tax (GST) is a consumption tax that applies to the sale of most goods and services in India, including cars. The GST on cars has been subject to revisions over time, and understanding the implications is crucial for car buyers.

The Basic GST Rate on Cars

Currently, the GST on cars is categorized based on the vehicle’s type and price. The standard GST rates for cars in India are:

-

28% GST on most passenger vehicles

-

18% GST on electric vehicles (EVs)

-

12% GST on low-priced cars (entry-level models)

These rates help define the tax burden on car buyers across various segments.

GST on Luxury Cars

Luxury cars in India attract a higher GST rate. Cars above a certain price point, including high-end models from brands like BMW, Mercedes, and Audi, are taxed at:

-

28% GST with additional cess charges ranging from 1% to 22%, depending on the engine capacity and price of the car.

The high GST rate on luxury vehicles ensures that these cars remain a significant investment for the buyers.

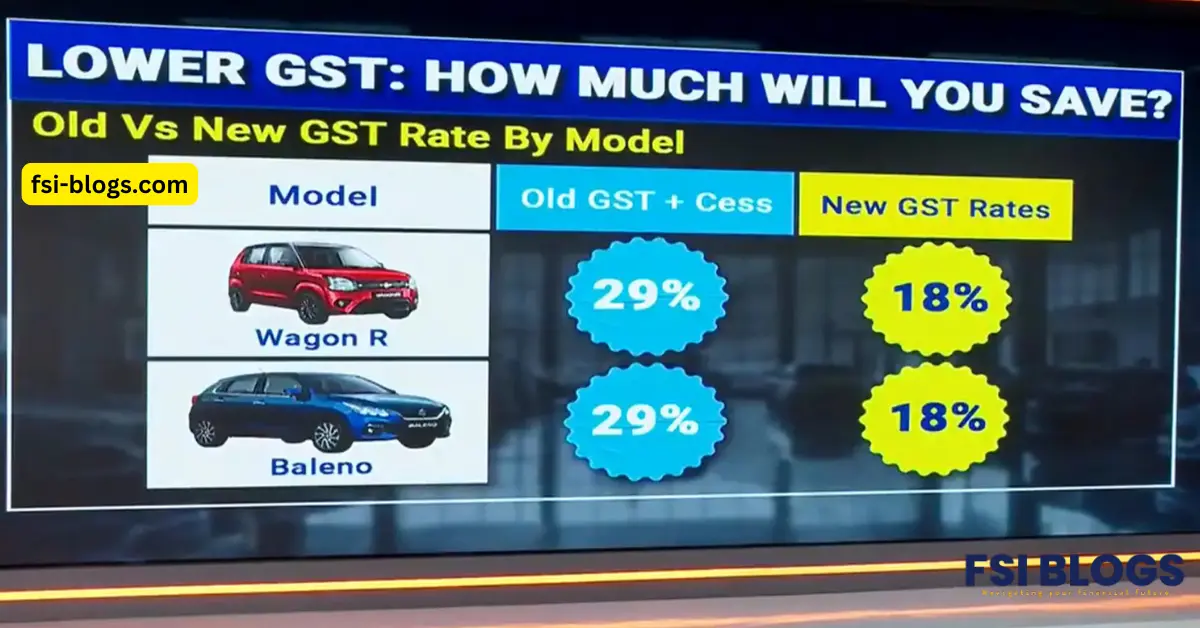

New GST Rates for Cars in 2025

As of 2025, the Indian government has updated its GST rates for several sectors, including the automobile industry. The new GST rates for cars reflect both tax adjustments and efforts to make electric vehicles more affordable.

Key Changes in the New GST Rates

The major changes in the new GST rates include:

-

GST on Electric Cars: Electric vehicles now have a reduced GST of 18% compared to 28% previously.

-

GST on Hybrid Cars: Hybrid vehicles are generally taxed at 28% with applicable cess.

-

GST on Import Cars: Import duties for high-end imported cars may still apply, making them expensive in comparison to domestically manufactured models.

Pre-GST vs Post-GST Car Price Comparison in India

| Car Category | Pre-GST Tax Rate (Approx.) | Post-GST Tax Rate | Price Impact Post-GST |

| Small Petrol Cars | ~31-33% | 29% | Minor price decrease |

| Small Diesel Cars | ~33-35% | 31% | Slight decrease |

| Mid-sized Cars | ~40-45% | 43% | Moderate increase |

| Luxury Cars | ~50-55% | 48% | Notable price drop |

| SUVs | ~50-55% | 50% | Mostly stable |

| Electric Vehicles | ~20-30% | 5% | Significant decreas |

GST on Bikes: How It Impacts Two-Wheelers

In India, two-wheelers are also subject to GST, though the rates differ significantly from those applied to cars.

GST on Bikes: Current Rates

-

28% GST applies to bikes with an engine capacity exceeding 350cc, including premium motorcycles.

-

18% GST applies to motorcycles with a lower engine capacity.

GST on Electric Bikes

Electric bikes are increasingly popular in India, and the government has made efforts to promote EV adoption. Electric two-wheelers have a reduced 5% GST compared to regular petrol-powered bikes, making them a more attractive option for eco-conscious buyers.

GST on Electric Vehicles (EVs): A Boost to Sustainability

The government has been actively promoting the adoption of electric vehicles (EVs) through subsidies and tax incentives. One of the key incentives is the 18% GST on EVs, which is considerably lower than the GST on conventional cars.

Benefits of GST on EVs

-

Lower Purchase Cost: The reduced GST rate for electric vehicles makes them more affordable, encouraging adoption among consumers.

-

Environmental Impact: By making EVs more affordable, the government aims to reduce carbon emissions and promote a sustainable environment.

GST on Car Prices in India

The introduction of GST has significantly impacted the car prices in India. Initially, car prices witnessed a surge due to the implementation of GST, but over time, the impact has leveled off.

The Breakdown of Car Price Structure Post-GST

Car buyers in India should consider the following factors when purchasing a vehicle:

-

Base Price of the Car

-

GST Taxation

-

Additional Costs: Road tax, insurance, and other state-specific taxes

Understanding these costs is crucial for estimating the total price of a car.

How GST Affects the Car Industry in India

GST has played a transformative role in the Indian automotive sector. The implementation of GST helped streamline the tax structure, reducing the complexities associated with inter-state tax systems.

Impact on Car Manufacturers

-

Cost Efficiency: Manufacturers benefit from reduced logistical costs and the simplification of tax systems.

-

Increased Demand for Entry-Level Cars: Lower taxes on entry-level cars have stimulated demand in the budget segment.

Impact on Car Dealers and Buyers

-

Price Transparency: GST has ensured more transparent pricing for cars.

-

Consumer Awareness: With clear tax rates, consumers are better informed about the cost of their vehicle purchases.

Bike GST: What You Should Know

The GST on bikes follows a different structure from that of cars, with rates typically lower for most two-wheelers.

Key Points on Bike GST

-

GST on Entry-Level Bikes: 18% GST is applicable on low-end motorcycles, which helps make them affordable for the general public.

-

GST on Premium Bikes: Premium motorcycles attract a 28% GST rate, which reflects the higher value of the vehicle.

The Future of GST on Cars and Bikes in India

The Indian government is likely to continue revising GST rates as part of its strategy to support the automobile sector, including electric vehicles and hybrid models.

Key Expectations for the Future

-

Further Reductions in EV GST: As EV adoption increases, there could be further reductions in GST to make them more accessible.

-

GST on Hybrid Cars: Hybrid cars might receive special GST treatment in the future to align with sustainability goals.

Conclusion

The GST on cars, bikes, and electric vehicles in India is an essential factor in determining the overall cost of owning and operating a vehicle. With the new tax rates introduced in 2025, car buyers can now benefit from lower taxes on electric vehicles and hybrid cars. Understanding the various GST rates and their implications can help consumers make informed decisions when purchasing a vehicle.

FAQs Section

What is the GST rate on cars in India?

The GST rate on most passenger cars is 28%, with additional cess applicable to luxury vehicles.

How much GST is charged on electric vehicles?

Electric vehicles in India are taxed at a reduced GST rate of 18%.

Is there a GST exemption for electric bikes?

Electric bikes are taxed at 5% GST, which is considerably lower than the GST on petrol-powered bikes.

How does GST impact car prices in India?

The GST rate on cars has led to increased transparency in pricing, with varying rates depending on the type and value of the car.

What is the GST on luxury cars?

Luxury cars in India are subject to a 28% GST along with an additional cess based on engine capacity and price.

Read More Articles : FSIBlogs